A Guide to Customer Retention Emails and Dunning Emails

Churn is the silent killer for SaaS companies. Typically, SaaS companies track churn (also known as customer churn rate) as a percentage. There is a healthy debate in the SaaS community about what kind of churn rate founders should aim for. Coming up with a good number is difficult for a few years. First, churn rates vary depending on company maturity (i.e., startup vs. well-established company). Second, there is a big difference between tracking monthly vs. annual churn rates.

To simplify the debate, consider two benchmarks noted by CoBloom:

• Pacific Crest Study: this survey found an average annual churn of 10% across more than 300 companies

• CoBloom guideline: the company suggests an ideal churn range of 5-7% after reviewing multiple sources.

Developing the perfect measure of churn is not our goal here. Instead, our goal is how we can use SaaS emails to keep more customers. That said, it is worth considering churn rates monthly and annually to get a sense of your company’s overall success in keeping customers happy.

For SaaS companies that rely on credit card payment, it is crucial to spend some time on the concept of dunning. The term “dunning” originated in the business several centuries ago. It refers to the process of following up with customers to get paid. In the SaaS context, dunning emails are most commonly used to get customers to enter valid payment information. From time to time, credit cards expire, or people close their accounts. You can send dunning emails to those customers to get them paying again.

There are a few points to keep in mind with customer retention emails.

• Use Customer Activity As A Guide. Customers with minimal product usage are more likely to cancel their subscriptions. Therefore, you may want to take the time to identify those customers and reach out to them. Manual outreach to high-value customers, especially those on enterprise plans, is often worthwhile. You may find out that firewalls or a critical integration is failing, which is why the customer hasn’t used the product.

• Use A Loyalty Program. Retailers have used loyalty programs to boost retention and revenue for years. That’s why the average consumer belongs to more than ten loyalty programs, according to The Loyalty Report. For example, consider offering a free month of product access after a customer has been with you for a year. Offering a surprise like this has a cost, but that cost is almost certainly lower than landing a new customer.

• Avoid Giving Up On Past Customers. When a customer closes their account, you should never contact them again. That’s the conventional wisdom. For the most part, it is a good rule to follow. There are some exceptions, though. After some time has passed - at least one month - consider reaching out to a past customer with a special offer to join again. In 2021, this strategy is essential to keep in mind. In 2020, many companies cut expenses to stay afloat. As the economy improves, it might be time to reach out again.

There are a few key points to keep in mind with dunning emails. SaaS companies that rely on credit card payments, getting these emails right is well worth the effort.

The purpose of the trial ending emails is simple: encourage a user to sign up for a paid account. Most commonly, this type of email is used for products that have a free trial. Keep the following principles in mind as you create or improve your trial-ending emails.

Use these principles to convert more of your trial-ending emails.

• Identify Expiration Dates Systematically (And Check Out This Stripe Feature) Credit cards expire, and your payment system has the expiration date. If you rely on a third-party system like Stripe for payments, this may get more difficult. However, Stripe has a feature that can help called “automatic card updates.” In brief, Stripe works with major card issuers to update card details when a customer receives a new card. This capability can help you to reduce attrition due to accidental card expiration.

While the Stripe capability is helpful, it is not a magic pill. The feature doesn’t apply to non-US cards at this time. Therefore, you may want to reach out to the payment processing service to see if they can help you identify the name and expiration date of cards.

• Credit Card Payment Failed. In some circumstances, proactive efforts to find expired cards will not be enough. Some card payments will simply not go through. This can happen for various reasons, like a customer closing their card account, expiration, or errors. When this happens, assume that your customer wants to keep using your service. In your email to the customer, state that their payment did not go through and make it easy to update their details.

• How To Manage Non-Credit Card Payment Problems On larger B2B SaaS plans, credit card payment is less common. For example, Owler has one hundred customers who are paying $100,000 per year. They are not the only B2B SaaS company with six-figure prices either. Many enterprise companies charge over $100,000 per year for their products. In these situations, a dunning email is probably not the right approach.

When payment problems happen in these cases, start by reviewing what you know about the customer. For instance, find out their payment history (i.e., typically 30 days after invoice). If the typical payment time has already elapsed, ask your salesperson to reach out to the company. There is a good chance that something went wrong in accounts payable, like a coding error or a typo on the invoice.

Unfortunately, easy to fix errors are not the only problem you will encounter. When new management comes in, they may want to review all spending. In these situations, you essentially have to resell the customer. That process goes beyond the scope of this guide.

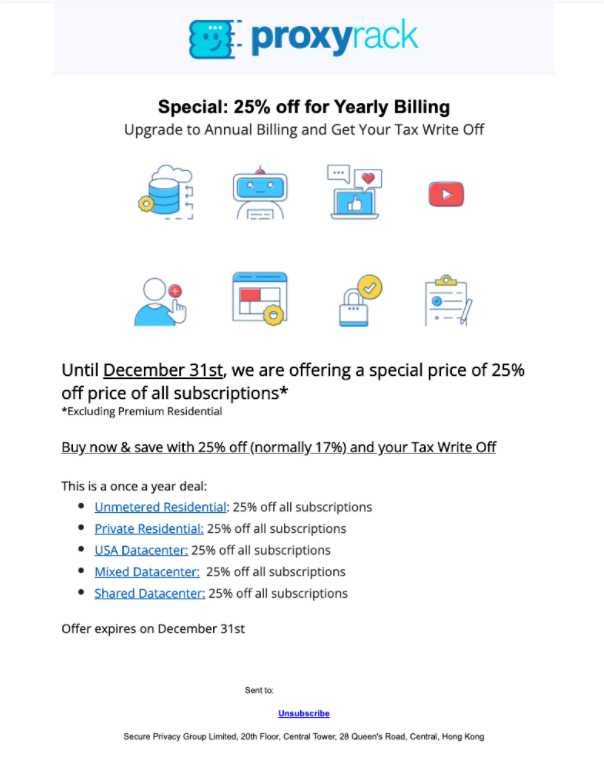

Email Credit: ProxyRack

Analysis of ProyRack’s Customer Retention Email

The ProxyRack email shows an excellent tactical approach to retention in the SaaS world. Give customers a reason to switch to yearly billing.

• Discount Offer The offer is front and center: buy the annual plan and get a discount. The discount offer is consistent on each plan (i.e., 25% off across the board).

• Deadline Urgency Positioned as a way to get a tax write-off, the email offers a clear deadline - December 31 - to take action. In addition, the deadline is credible because it is tied to the end of the calendar year.

The ProxyRack email hits the fundamentals of a price-driven offer well. There are a few ways to make it better.

• Revise The Graphics To Support The Offer. The email includes a block of eight graphic icons. There doesn’t appear to be any link between these graphics and the offer. I would suggest removing these graphics or redesigning them to fit the offer. For instance, the email could use a calendar-style graphic to emphasize the deadline on the offer.

• Personalize The Offer. The discount offer does not refer to the customer’s current plan. It would be more effective to call out the plan currently used by the customer (e.g., “Want to save 25% on your Shared Datacenter plan?”)

• Translate The Offer Into Dollar Terms. Research published in 2018 (“The problem with percentages”) reported that many college students do not correctly understand percentage changes even when given unlimited time. We might hope that our customers are better at math than college students. However, your customers certainly do not have unlimited time. This means that the percentage off deals may not make an impression. The solution is simple. Translate the percentage off offer into dollars saved.

The revised copy might look like this: “25% on the shared data center plan (save $150).”

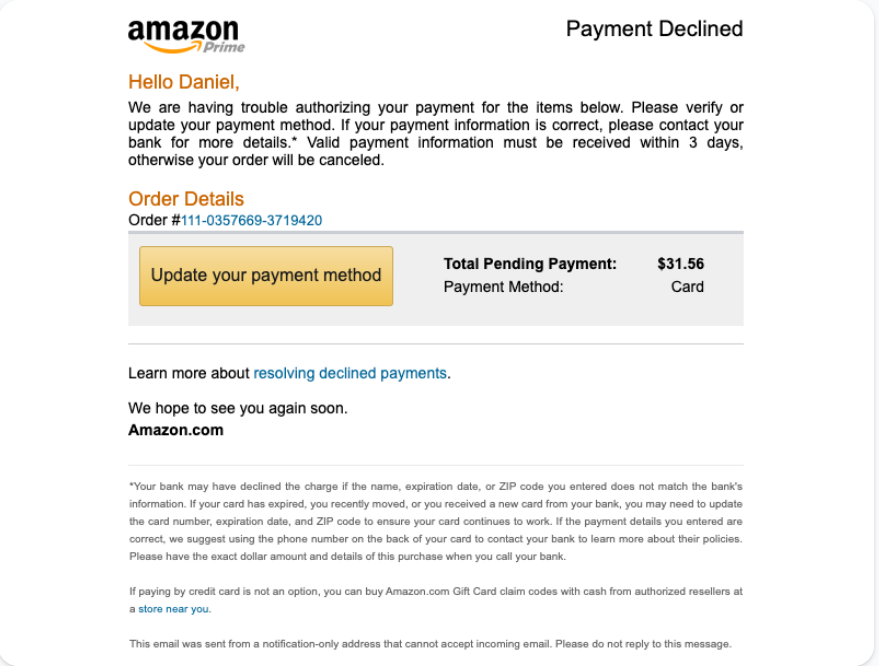

Email Credit: Amazon

Analysis of Amazon’s Credit Card Declined Email

Amazon is hitting all of the basics in this payment problem.

• Assume Responsibility. No customer likes to be told that they made a mistake like entering an incorrect credit card number. The Amazon approach generously takes the blame by stating: “We are having trouble authorizing your payment.”

• Credibility. Fraudsters could potentially spoof this type of email. To mitigate that concern, the Amazon email is personalized in several ways: customer first name, customer order number, and payment amount. Taken together, these details indicate that the email is genuine.

There are some optimization opportunities for the Amazon email.

• Alternate Payment Methods. In the tiny small print at the bottom of the email, Amazon mentions that you can buy Amazon gift cards to pay for your purchases. That is a good option for people with money in their checking account but problems with a credit card. I would suggest moving this offer up to the bottom of the body of the email. In addition, revise the copy to state how many resellers there are in the customer’s state (e.g., there are 1,000 resellers in New York State).

• Emphasize The Deadline. The Amazon email states that the customer has three days to update their payment information or cancel the order. Consider updating this to a specific date to make more of an impact on the customer.

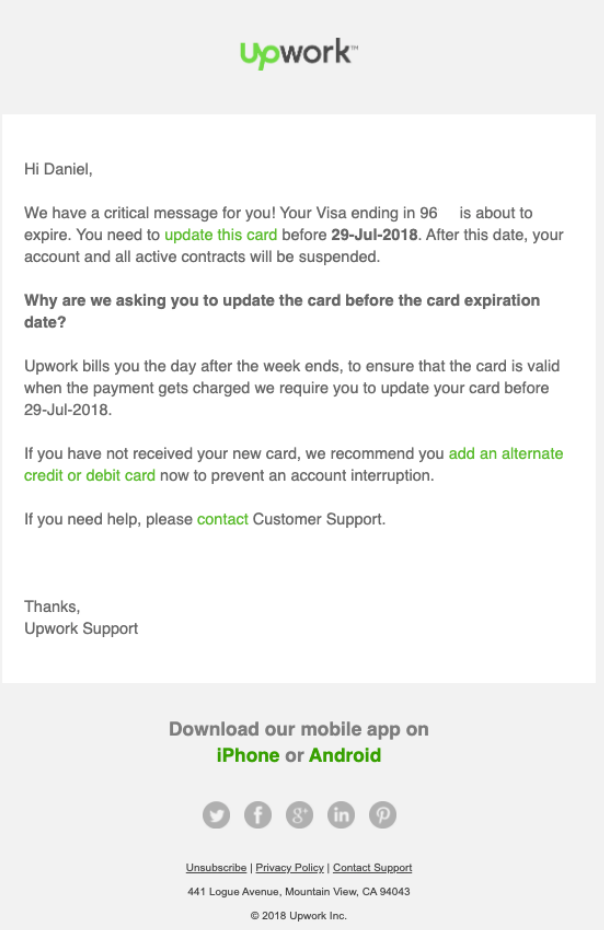

Email Credit: Upwork

Analysis of Upwork’s Cancellation Email

The Upwork credit card expiration email is one of the best expiration-focused emails we’ve seen.

• Specificity! The email is crystal clear about the credit card. The first name addresses the customer, the last four digits of the credit card are shown (we cut out two of the digits in the screenshot for privacy reasons), and the expiration date is precise.

• Early Action. Upwork explains why they are asking the customer to update their credit card early. The reason is that the company has a weekly billing cycle.

Upwork might be able to boost action by making a few tweaks to the email.

• Reference Customer Activity. The email vaguely states that “all active contracts will be suspended.” It would be more compelling if the email stated the number of active contracts. For instance: “Your five active contracts will be suspended.” After all, the customer may have no active projects.

• Emphasize The Pain of Inaction. The email states that “your account and all active contracts will be suspended.” Yet, I don’t know exactly what that means. Therefore, add further explanation to the email. “Freelancers will be informed that your account is suspended due to payment problem, and they are entitled to stop work on your projects without penalty.”

This approach reminds the business owner that their projects and deadlines may be missed if they do not take action.

Boosting customer retention takes more than emails. You also need to have a compelling product, capable customer service or customer success team, and reasonable pricing. However, retention emails give you a way to boost revenue on the margin. Some of your customers may let their accounts lapse when their credit cards expire. Use the case studies to inform your approach to customer retention.

ProxyRack's email retains customers by giving them a discount. The discount email is even more effective because it is backed up by a precise deadline (i.e., December 31). Amazon's payment problem email also gives customers a clear reason to act - pending orders will be canceled in 3 days if valid payment information is not received. To avoid the perception of a phishing email, note how Amazon states the exact amount of the pending payment and cites the order number. These specific details send a clear signal to the user that they should take this email seriously.

For more customer retention dunning email templates, check out the Dunning Email Templates section of SaaS Email Templates!

I am the founder and CEO of Messaged, the email marketing automation platform built for SaaS companies.

My email is [email protected] and I am @tldrdan on Twitter; if you have specific feedback or questions related to this guide, I would love to hear from you!

Email Marketing Automation for SaaS Businesses

Start your 14-day free trial or contact sales to book a free demo. Start growing your SaaS business today!